Investor Experience Index Q3, 2025: LP Takeaways

Never miss an Invest Clearly Insights article

Subscribe to our newsletter today

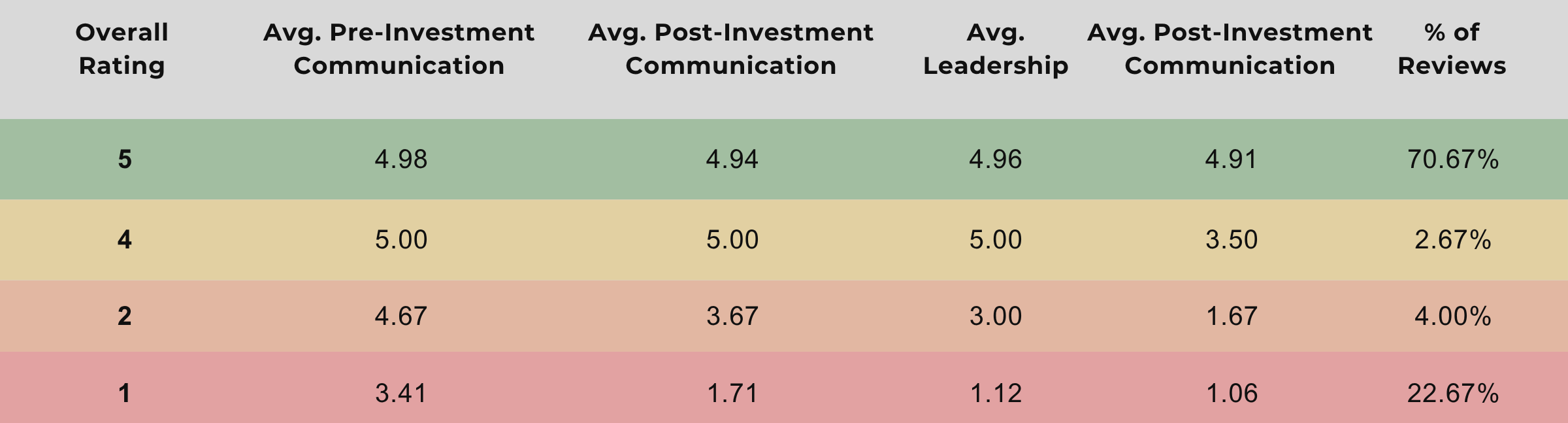

The Investor Experience Index provides a quarterly snapshot of how limited partners (LPs) rate their experiences with general partners (GPs). The data for this report is drawn exclusively from verified investor reviews published on Invest Clearly in Q2 2025.

When reviews are submitted to Invest Clearly, LPs provide an overall score but are also asked to rate sponsors across four specific data points:

- Pre-investment communication

- Post-investment communication

- Strength of leadership

- Alignment of expectations

These inputs, along with overall ratings, provide a detailed view of investor sentiment. By analyzing how category scores correlate with overall ratings, we can identify which sponsor behaviors most strongly influence satisfaction, trust, and the likelihood of reinvestment.

More Users & More Reviews!

Invest Clearly continues to gain traction among both limited partners (LPs) and general partners (GPs). In Q2 2025, reviews on the platform grew by 29%, signaling rising trust and broader adoption within the passive real estate investing community. Notably, 71% of new reviews were 5-star ratings, and 85% of those top reviews were submitted for claimed sponsors—an indication that GPs actively encouraged investors to provide feedback.

Ratings Are Polarized — Averages Can Be Misleading

.png)

Q3 2025 reviews show a highly polarized distribution of investor experiences.

- 70% of reviews are 5-star, reflecting strong satisfaction among many LPs.

- Nearly 25% are 1-star, signaling a meaningful segment of investors who report serious issues.

- Mid-range ratings are rare, suggesting sponsors tend to either deliver exceptionally well or fall short entirely.

👉 Why it matters: The polarized reviews reflect how GPs perform in practice—either delivering exceptional experiences or falling short, breaking investor trust. As more LPs share feedback, this split becomes clearer, helping investors identify standout sponsors and exposing underperformance.

Pre-Investment Communication: Least Likely to Indicate Investment Success

Pre-investment communication refers to all sponsor-LP interactions before a capital commitment is made. This may include:

- One-on-one conversations with GPs or IR teams

- Email campaigns (automated or direct)

- Pitch decks and offering materials

- Subscription flow and onboarding processes

Despite being many investors’ primary touchpoint, pre-investment communication is the least reliable predictor of overall satisfaction. Data from Q2 shows that:

- LPs who gave an overall rating of 2 still rated pre-investment communication 4.67 on average.

- Even 1-star reviews had a 3.41 average in this category.

👉 LP Takeaway: A good pitch doesn’t equate to good execution.You cannot rely solely on pre-investment communication to assess a sponsor’s trustworthiness. Instead, weigh multiple factors, read investor reviews, and dig deeper into the track record of marketed and realized results.

Questions to Ask a GP:

- “How do your realized returns compare to what was originally projected across past deals?”

- “Tell me about a deal that underperformed? Why did that happen and how did your firm react?”

- “Can you point to deals where you successfully navigated downturns?”

- “Are your historical performance figures third-party verified or audited?”

The Link Between Leadership and Investor Satisfaction

Leadership performance continues to be one of the clearest indicators of LP satisfaction and overall investment experience. High leadership scores correspond with strong communication and aligned expectations throughout the lifecycle of the investment.

When evaluating GPs, consider clusters of low ratings a warning sign, even if their average seems “okay.” The data shows sponsors with poor leadership rarely deliver. The data suggests LPs should place significant weight on a sponsor’s leadership track record and accessibility — not just their marketing materials.

-2.png)

Questions to Ask a GP:

- “Can you walk me through a time you faced an operational or market challenge? How did leadership respond?”

- “How does leadership stay engaged with LPs after capital is raised?”

- “Who are the decision-makers on asset management and investor relations — and how long have they been with the firm?”

- How are the deals currently in your portfolio performing?

Incorporate LP Feedback Into Diligence.

When evaluating a new sponsor, make reading verified investor reviews as routine as reading an OM or underwriting a deal. Combine this with direct outreach to past investors to validate past performance and uncover gaps that may not be obvious from marketing materials alone.

Written by

Invest Clearly empowers you to make informed decisions by hosting unbiased reviews of passive investment sponsors from verified experienced investors.

Other Articles

Real Estate Recapitalizations—What Passive Investors Need to Know

A recapitalization is a restructuring of a property's capital stack (the mix of debt and equity that finances an investment). While they can be legitimate business strategies, transparency can be an issue.

How to Evaluate a Potential Investment Using the FUND Framework

The FUND framework is a simple way to evaluate opportunities by looking at four pillars: Financials, Underlying Assets, Notable Differentiator, and Delegation of Responsibilities.

What Needs to “Die” in Passive Investing – According to Guests of The Invest Clearly Podcast

Get the answer to the closeout questions of each podcast episode: “What do you think needs to die in passive investing?” The answers are wide-ranging, from misconceptions about risk, to misleading marketing tactics, to structural issues in how deals are presented.

Passive Real Estate Investing Advice from Experienced LP Investors

Experienced LPs shared their most valuable lessons, drawn from years of investing across various asset classes and sponsor relationships.

From Land to Lease-Up: The Lifecycle of a Multifamily Development Deal for LPs

This guide walks you through the typical timeline of a multifamily development project from the LP perspective. Learn when investors come on board, what happens during construction and lease-up, and how profits are realized at exit.

How to Spot Red Flags in Private Real Estate Deals: 10 Risks Every Investor Should Know

The SEC reported that investment scams cost Americans more than $5.7 billion in 2024, with many cases tied to private offerings (like real estate syndications) lacking oversight. Here are ten critical red flags every investor should be able to identify before committing funds to a real estate deal.